Buying a boat is exciting! Whether you dream of fishing trips, weekend sails, or family adventures on the lake, owning a boat brings fun and freedom. But boats can be expensive, and most people need a loan to buy one. That’s where a boat loan calculator comes in handy.

This simple tool helps you understand how much your dream boat will really cost each month. It also shows how interest rates, loan terms, and down payments affect your total payment. In this guide, you’ll learn exactly how to use a boat loan calculator, what factors to consider before applying for a loan, and how to save money along the way.

Let’s dive in and make boat buying easy, smart, and stress-free!

Table of Contents

1. What Is a Boat Loan Calculator?

A boat loan calculator is an online tool that helps you figure out your monthly loan payments. You enter details like the loan amount, interest rate, and loan term, and it quickly gives you a payment estimate. It’s like a budgeting friend who helps you see what you can afford before talking to a lender.

This calculator works for all types of boats—speedboats, sailboats, pontoons, and even yachts. It takes the guesswork out of financing, so you can plan your purchase with confidence. By knowing your estimated monthly payment in advance, you can make smarter choices and avoid surprises later.

2. Why You Should Use a Boat Loan Calculator Before Buying

Before you sign any papers or visit a dealer, take a few minutes to use a boat loan calculator. It’s one of the easiest ways to understand how your loan will work. With a few clicks, you’ll see how much you’ll pay over time and how changing your loan terms can save money.

For example, a shorter loan term means higher monthly payments but less interest overall. A longer term lowers your monthly bill but increases total interest paid. The calculator shows you both options side by side, helping you pick what fits your budget best.

3. How a Boat Loan Works

A boat loan is like a car loan. You borrow money from a lender, agree on a repayment plan, and pay interest until the loan is paid off. Lenders may offer different terms, from 2 to 20 years, depending on the amount and your credit score.

Most boat loans are secured loans, meaning the boat itself acts as collateral. If you stop making payments, the lender can take the boat back. That’s why knowing your exact payments through a boat loan calculator is so important—it keeps you from borrowing more than you can handle.

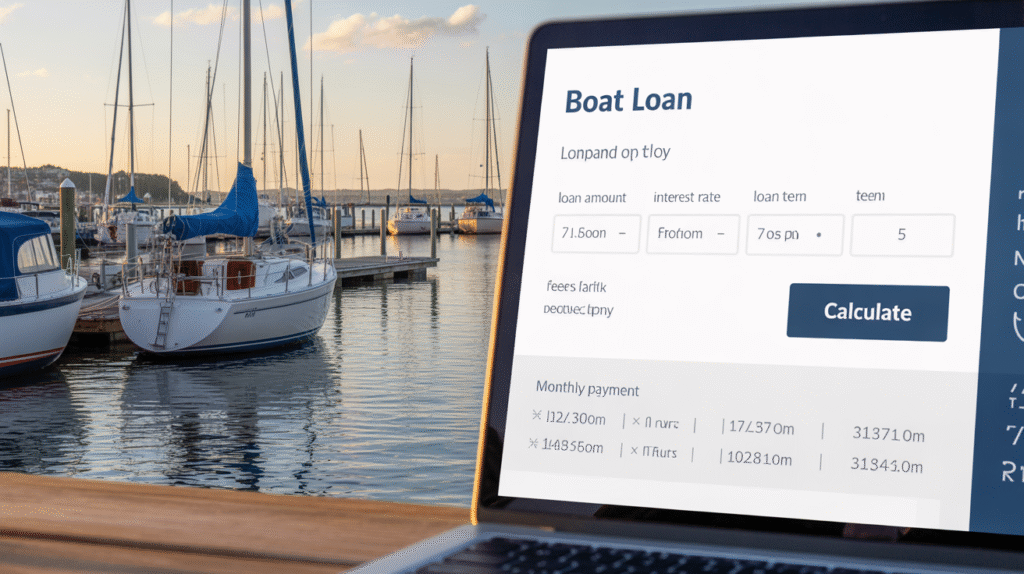

4. What You Need to Use a Boat Loan Calculator

To get the best results, you’ll need to enter a few simple details:

- Boat price: The total cost of the boat.

- Down payment: The amount you’ll pay upfront.

- Loan term: How long you’ll take to pay it back.

- Interest rate: The rate your lender charges you.

Once you enter these numbers into the boat loan calculator, you’ll instantly see your estimated monthly payment and total loan cost. Some calculators also show how much interest you’ll pay over the life of the loan, which is helpful for comparing deals.

5. The Benefits of Using a Boat Loan Calculator

Using a boat loan calculator saves time, reduces stress, and helps you stay in control of your money. Instead of guessing what you can afford, you get real numbers that make planning simple.

You can also test different situations. Want to see how much you’ll save with a bigger down payment? Just adjust the numbers and compare. Curious how interest rates affect your budget? Change the rate and watch the results update.

It’s a powerful, free tool that makes you a smarter buyer—and lenders love borrowers who understand their finances!

6. How Interest Rates Affect Your Boat Loan

Interest rates play a big role in how much your loan costs. Even a small difference can change your total payment by thousands of dollars. For instance, a 6% loan versus an 8% loan can add hundreds to your monthly payment.

By using a boat loan calculator, you can see how different rates change your total cost. This helps you find the best deal and know when to shop around for better terms.

Remember, lenders set rates based on your credit score, loan term, and down payment. Improving your credit or choosing a shorter loan term can help you get a lower rate.

7. How Your Credit Score Impacts Boat Loan Approval

Your credit score shows lenders how well you handle money. A higher score means you’re more likely to get approved for a loan with a lower interest rate.

Before you apply, check your credit report for errors and try to pay down other debts. Even a small credit boost can help lower your payments. Then, use a boat loan calculator to see what your new rate means for your budget.

If your score is low, don’t worry—you can still get a loan, but your rate may be higher. Some lenders specialize in marine loans for borrowers with less-than-perfect credit.

8. Deciding on the Right Loan Term

Boat loans come with many term options. Some people choose shorter terms, like five years, to pay off the boat faster. Others prefer longer terms, like ten or fifteen years, for smaller monthly payments.

A boat loan calculator makes comparing these options easy. You can see exactly how much you’ll pay each month and how much interest you’ll save with a shorter term.

If you plan to keep the boat for many years, a longer term might make sense. But if you want to save on interest, shorter terms are the smarter choice.

9. Down Payments and How They Help You Save

A down payment is the amount you pay upfront when buying a boat. The bigger the down payment, the smaller your loan—and your monthly payments.

For example, putting 20% down can lower your loan costs dramatically. When you use a boat loan calculator, you can see how your payment changes with different down payment amounts.

Saving for a larger down payment also shows lenders that you’re serious and responsible, which might help you get a better rate.

10. Comparing Loan Offers Using a Boat Loan Calculator

Not all loans are created equal. Two lenders can offer very different terms for the same boat. That’s why it’s smart to compare.

Using a boat loan calculator, you can enter each lender’s offer and see which one costs less over time. Look beyond the monthly payment—focus on total interest and loan length, too.

This quick comparison helps you avoid paying more than you need to and ensures you choose the best financing option available.

11. Common Mistakes to Avoid When Financing a Boat

Many first-time buyers rush into loans without checking all the details. Avoid these mistakes:

- Not using a calculator: Always check affordability first.

- Ignoring extra costs: Don’t forget fuel, maintenance, and insurance.

- Choosing too long a term: You may end up owing more than the boat is worth.

A boat loan calculator helps you see the big picture and avoid surprises. Take your time, understand your numbers, and plan wisely.

12. Tips for Getting the Best Boat Loan Deal

To get the best loan, do a little homework. Compare multiple lenders, improve your credit score, and make a healthy down payment.

Also, consider getting pre-approved before shopping. This shows dealers you’re a serious buyer and helps you negotiate better. Use a boat loan calculator to double-check your budget so you don’t overspend.

Remember: the best deal isn’t always the lowest monthly payment—it’s the one that fits your long-term financial plan.

13. Online Boat Loan Calculators vs. Dealer Calculators

You’ll find many calculators online, but not all are the same. Some are designed by lenders to promote their own loans, while others are neutral and just show the math.

Try using several boat loan calculators from trusted sites and compare their results. This helps you get a clearer idea of your payments before committing to a loan.

A good calculator should be easy to use, transparent, and show both monthly payments and total interest paid.

14. How to Budget for Boat Ownership

Your loan payment is only one part of boat ownership. You’ll also need to budget for fuel, maintenance, docking fees, and insurance. These costs add up quickly if you’re not prepared.

When using a boat loan calculator, consider these extra expenses in your monthly budget. It’s better to plan for more than less.

This helps you enjoy your boat without money worries. After all, boating should be fun—not stressful!

15. Real-Life Example: Using a Boat Loan Calculator in Action

Let’s say you’re buying a $50,000 boat. You put $10,000 down and borrow $40,000 at a 6% interest rate for 10 years. Using a boat loan calculator, your monthly payment would be about $444.

Now, if you choose a 7-year loan instead, your payment rises to around $586, but you’ll save thousands in interest. This simple example shows how changing your loan term affects your total cost.

With these insights, you can choose what fits your lifestyle and budget.

16. The Smart Way to Pay Off Your Boat Loan Early

If you can, make extra payments! Paying a little more each month can cut years off your loan. Before doing this, check that your lender doesn’t charge prepayment penalties.

Use a boat loan calculator to see how adding $100 or $200 per month changes your total interest. You’ll be surprised at how much you can save over time.

This strategy not only saves money but also helps you build equity faster in your boat.

Frequently Asked Questions

1. What is the best boat loan calculator online?

There are many great options, but choose one from a trusted source like your bank or a major lender. Look for a boat loan calculator that shows total interest, monthly payments, and allows easy adjustments.

2. Does a boat loan calculator include taxes and fees?

Most calculators only estimate loan payments. Always add sales tax, registration, and insurance costs separately for an accurate budget.

3. Can I use a boat loan calculator for used boats?

Yes! A boat loan calculator works for both new and used boats. Just enter the correct purchase price and interest rate based on your loan offer.

4. How accurate are the results from a boat loan calculator?

They’re close but not exact. Your actual payment depends on your lender’s specific terms, fees, and your credit score.

5. Can I lower my monthly payment using a calculator?

Yes! Try adjusting the loan term, down payment, or rate in your boat loan calculator to find a payment that fits your budget.

6. What’s the best loan term for a boat?

That depends on your goals. A shorter term saves money on interest, while a longer one offers lower monthly payments. Use a calculator to compare both.

Conclusion: Take Control of Your Boat Financing Today

A boat loan calculator is one of the best tools for anyone thinking about buying a boat. It helps you plan, budget, and make smart financial choices without stress. By seeing your numbers in advance, you’ll feel confident when you walk into the dealership or apply online.

Remember, buying a boat should be exciting—not confusing. Take a few minutes to play with the calculator, compare options, and build a loan that truly fits your life.

Then, when you finally set sail, you’ll know you made the best financial choice possible. Happy boating!